Is the current backdating scandal a result of director negligence or director complicity?

Before Comverse announced its internal probe, John Friedman, a member of the board's compensation committee, said directors had noticed the scattered nature of the grants -- eight between 1994 and 2001 fell in six different months -- but management assured them there were valid reasons.

This week, Comverse said that, as a result of the board's review of its options grants, it expects it will need to restate past financial results.

Thursday, May 25, 2006

Quotable Quote

Backdating "represents the ultimate in greed," says Arthur Levitt, a former chairman of the Securities and Exchange Commission. "It is stealing, in effect. It is ripping off shareholders in an unconscionable way."

Breaking the law: Breaking news

As more news breaks about companies suspected or investigated in connection with options backdating, it may be useful to maintain (and keep updating) a list of companies that have come under fire.

Here's a quick-reference list! (Sources: WSJ articles and other newspapers. Please let me know if any dates are off.)

Company Date implicated Who initiated itAnalog Devices Fall 2005 SEC

Mercury Interactive 1-Nov-05 Company

Affiliated Computer

Services 18-Mar-06 WSJ

Brooks Automation 18-Mar-06 WSJ

Comverse Technology 18-Mar-06 WSJ

Jabil Circuit 18-Mar-06 WSJ

United Health 18-Mar-06 WSJ

Vitesse Semiconductor 18-Mar-06 WSJ

Power Integrations 5-May-06 Company?

Altera Corp. 8-May-06 Company

Caremark Rx 18-May-06 SEC, Grand Jury

SafeNet 18-May-06 US Attorney, SEC

Semtech 18-May-06 SEC

Nyfix 19-May-06 US Attorney

Sycamore Networks 19-May-06 SEC

RSA Security 19-May-06 SEC

Boston Communications

Group 22-May-06 WSJ

CNET Networks 22-May-06 WSJ, then SEC

F5 Networks 22-May-06 SEC, Grand Jury

Juniper Networks 22-May-06 US Attorney

KLA Tencor 22-May-06 WSJ

Meade Instruments 22-May-06 WSJ

Openwave Systems 22-May-06 SEC

Quest Software 22-May-06 Company

Renal Care Group 22-May-06 WSJ

Trident Microsystems 22-May-06 WSJ

Medarex Inc. 24-May-06 SEC

Here's a quick-reference list! (Sources: WSJ articles and other newspapers. Please let me know if any dates are off.)

Company Date implicated Who initiated itAnalog Devices Fall 2005 SEC

Mercury Interactive 1-Nov-05 Company

Affiliated Computer

Services 18-Mar-06 WSJ

Brooks Automation 18-Mar-06 WSJ

Comverse Technology 18-Mar-06 WSJ

Jabil Circuit 18-Mar-06 WSJ

United Health 18-Mar-06 WSJ

Vitesse Semiconductor 18-Mar-06 WSJ

Power Integrations 5-May-06 Company?

Altera Corp. 8-May-06 Company

Caremark Rx 18-May-06 SEC, Grand Jury

SafeNet 18-May-06 US Attorney, SEC

Semtech 18-May-06 SEC

Nyfix 19-May-06 US Attorney

Sycamore Networks 19-May-06 SEC

RSA Security 19-May-06 SEC

Boston Communications

Group 22-May-06 WSJ

CNET Networks 22-May-06 WSJ, then SEC

F5 Networks 22-May-06 SEC, Grand Jury

Juniper Networks 22-May-06 US Attorney

KLA Tencor 22-May-06 WSJ

Meade Instruments 22-May-06 WSJ

Openwave Systems 22-May-06 SEC

Quest Software 22-May-06 Company

Renal Care Group 22-May-06 WSJ

Trident Microsystems 22-May-06 WSJ

Medarex Inc. 24-May-06 SEC

Monday, May 22, 2006

Backdating of stock options: SEC probe triggered by academic papers

In yet another instance where academic research has alerted the SEC to take action against potentially illegal activities, research by Dr. Erik Lie at Iowa and Dr. Yermack at Stern led to the uncovering of the recent options backdating scandal.

If you know what options backdating is all about, skip this paragraph and go to the next one. For the benefit of readers who don't, here's a short summary. Employee stock options to buy shares at a preset "strike" price became a widespread form in the last 15 years or so. Recently, investigations have found that companies artificially set the grant date of these options to a day on which stock prices have been at a low ebb, thereby assuring executives of a fat profit on the day they are granted. By tying strike prices to earlier, more favorable dates, executives granted options can instantly lock in a paper gain -- and, if a stock goes up, increase their real gain when they exercise them. This defeats the incentive effect of employee stock options, which is to reward the executive only when their contributions result in a stock price increase. In the words of Dr. David Yermack, "The whole point of a stock option (as an incentive mechanism) is that you only profit if the stock goes up. If you fix it in advance so that it's already deep in the money, it eliminates a lot of the risk."

News sources including this one credit the discovery of this manipulation to Dr. Erik Lie and other academic researchers.

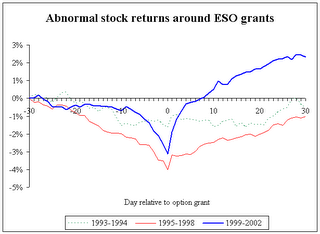

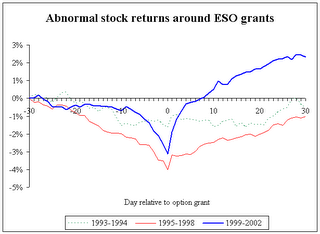

A great, simple explanation of this topic is found at Professor Lie's website here. The following graph from his website provides a good illustration of the magnitude of this problem, as the effect appears strong even after averaging over thousands of companies.

The latest developments including a timeline of options investigations, and the list of companies that have been caught backdating options are succinctly summarized in these WSJ articles.

If you know what options backdating is all about, skip this paragraph and go to the next one. For the benefit of readers who don't, here's a short summary. Employee stock options to buy shares at a preset "strike" price became a widespread form in the last 15 years or so. Recently, investigations have found that companies artificially set the grant date of these options to a day on which stock prices have been at a low ebb, thereby assuring executives of a fat profit on the day they are granted. By tying strike prices to earlier, more favorable dates, executives granted options can instantly lock in a paper gain -- and, if a stock goes up, increase their real gain when they exercise them. This defeats the incentive effect of employee stock options, which is to reward the executive only when their contributions result in a stock price increase. In the words of Dr. David Yermack, "The whole point of a stock option (as an incentive mechanism) is that you only profit if the stock goes up. If you fix it in advance so that it's already deep in the money, it eliminates a lot of the risk."

News sources including this one credit the discovery of this manipulation to Dr. Erik Lie and other academic researchers.

"A study, by Erik Lie, a finance professor at the University of Iowa's business school, looked at thousands of option grants. On average, he found a pattern of stocks dipping sharply just before the date of option grants, then rising immediately afterward -- even after adjusting for overall market returns. Equally striking, he found market prices as a whole tended to rise after grants -- which he suggested shows that executives may have backdated options, already knowing how the market moved.

A second study, by Prof. Lie and Randall Heron of Indiana University's business school, showed the patterns all but ceased after August 2002, when rules put in place by the Sarbanes-Oxley corporate-reform law began requiring executives to report option grants to regulators within two days, instead of the weeks or months previously allowed. With less leeway to choose a favorable grant date, "most of the effect disappeared," said Prof. Lie."

A great, simple explanation of this topic is found at Professor Lie's website here. The following graph from his website provides a good illustration of the magnitude of this problem, as the effect appears strong even after averaging over thousands of companies.

The latest developments including a timeline of options investigations, and the list of companies that have been caught backdating options are succinctly summarized in these WSJ articles.

Sunday, May 21, 2006

Back to regular posting!

Sorry for the long absence of posts, I'm back to regular posting. Please check in every day!

Wednesday, May 10, 2006

SOX rocks

A study by Lord & Benoit LLC finds that companies that have implemented internal checks and controls as required by Sarbanes-Oxley legislation (SOX) are rewarded by market-beating stock returns.

Further, even companies that perform internal checks, find irregularities, and correct them are rewarded by strong stock performance.

The full article is here.

This is not Lord & Benoit's first SOX study. An earlier study released in April concluded that that "the statistics raise questions" on whether small-cap and micro-cap companies can be relied upon to self-report material weaknesses in internal controls. Section 302 of the Sarbanes-Oxley law requires companies to self-report disclosure controls and requirements in internal controls.

Said Robert Benoit, president and director of SOX Research for Lord & Benoit, and author of the report, "From an ethical perspective, the report shows only 8 percent to 14 percent of the accelerated filers with material weaknesses self-reported their weaknesses. It was not until Section 404 that they were forthcoming. This kind of data makes me wonder."

Benoit added that about 50 of the companies studied had unethical behaviors, such as fraudulent reporting, employee fraud, Securities and Exchange Commission investigations, and accounting irregularities and misrepresentations.

Read more here.

Further, even companies that perform internal checks, find irregularities, and correct them are rewarded by strong stock performance.

The full article is here.

This is not Lord & Benoit's first SOX study. An earlier study released in April concluded that that "the statistics raise questions" on whether small-cap and micro-cap companies can be relied upon to self-report material weaknesses in internal controls. Section 302 of the Sarbanes-Oxley law requires companies to self-report disclosure controls and requirements in internal controls.

Said Robert Benoit, president and director of SOX Research for Lord & Benoit, and author of the report, "From an ethical perspective, the report shows only 8 percent to 14 percent of the accelerated filers with material weaknesses self-reported their weaknesses. It was not until Section 404 that they were forthcoming. This kind of data makes me wonder."

Benoit added that about 50 of the companies studied had unethical behaviors, such as fraudulent reporting, employee fraud, Securities and Exchange Commission investigations, and accounting irregularities and misrepresentations.

Read more here.

Verizon's reduction in CEO pay to deflect criticism

Verizon has substantially reduced pay of its CEO in anticipation of shareholder criticism.

From the WSJ news item:

From the WSJ news item:

"Last year, Verizon's board granted a long-term stock incentive package to Chief Executive Ivan Seidenberg that would have increased his 2005 compensation 50% from the year before to nearly $27 million. This past March, directors abruptly canceled a big chunk of that grant, initially valued at $7.6 million, before the increase had been widely publicized. The board acted -- with Mr. Seidenberg's approval -- amid concern about how shareholders would react to giving him a big raise after Verizon's stock had dropped 25% in 2005."

Friday, May 05, 2006

Newest executive pay issue: dividends on unvested restricted stock

An article in the WSJ today throws light on yet another murky executive pay practice. The recent furore regarding stock options has resulted in many companies opting to compensate their executives through restricted stock instead. Restrictive stock is in general a better way to align incentives as it is paid out only if the company meets certain performance targets. However, many companies pay dividends to executives on these unvested restricted stock, i.e. stock which the executives dont even own! They may own the stock in the future IF the performance targets are met, but they are paid dividends today.

The full article is here.

New SEC rules will require better disclosure of these dividends on unvested stock, but not disallow this policy.

"All told, among the 50 large-company CEOs who received the largest dollar grants of restricted stock over the past three years and whose companies pay dividends, 37 are paid dividends in cash before the shares vest, according to an analysis for The Wall Street Journal by Equilar Inc., a San Mateo, Calif., compensation-research firm.

Corporate-governance watchdogs and executive-pay consultants say the dividends on performance shares undermine the effort to link pay to performance. "It's more stealth compensation," says Paul Hodgson, a senior research associate at the Corporate Library, which monitors corporate governance."

The full article is here.

New SEC rules will require better disclosure of these dividends on unvested stock, but not disallow this policy.

A slow two weeks

Posts this week and the next will be sparse. I'm travelling and dont have the same kind of access I had before. Thanks for your patience - this wont last long!

Subscribe to:

Posts (Atom)