The WSJ had this great article about the Wall Watchers, an organization founded by Howard Leonard which monitors the uses of donations to religious organizations.

Another organization that does important work along these lines is the Better Business Bureau's Wise Giving Alliance. On their website, they have a set of comprehensive guidelines that seek "to ensure that the volunteer board is active, independent and free of self-dealing".

They include:

1. A board of directors that provides adequate oversight of the charity's operations and its staff.

2. A board of directors with a minimum of five voting members.

3. A minimum of three evenly spaced meetings per year of the full governing body with a majority in attendance, with face-to-face participation.

4. Not more than one or 10% (whichever is greater) directly or indirectly compensated person(s) serving as voting member(s) of the board. Compensated members shall not serve as the board's chair or treasurer.

Sunday, November 05, 2006

Buy-side vs. Sell-side

A look at what this common Wall Street terminology means:

TheStreet.com says:

" Sell-side firms are what people traditionally think of when looking for Wall Street jobs. These firms underwrite securities and advise on mergers and acquisitions through their corporate finance divisions. Their sales and trading divisions make secondary markets in a variety of securities, including stocks, bonds, currencies, swaps, commodities and derivatives. Analysts in research divisions make both macro (overall investment strategy) and micro (company-specific) recommendations.

Buy-side firms generally manage portfolios on behalf of clients. They include insurance companies like Aetna, investment management firms like Wellington Management, mutual fund companies like Fidelity and hedge funds like Moore Capital."

A clearer definition (I think) is this: the key is to think of basic financial instruments (stocks, bonds and the like). Buy-side firms (such as mutual funds) invest in these financial instruments. Sell-side firms sell these - for example, investment banks may underwrite a company's IPO, or help to sell the company's shares to the public (and take a cut).

Though the definition seems clear-cut, its not always this simple.

Where do commercial banks stand (they take deposits and issue loans)? They invest the deposits by buying securities - so buy-side? Or maybe - because they issue bank loans, a form of financing- sell-side? Officially, they're on the buy side.

Insurance companies sell what might be called a financial instrument, but they fall on the buy-side because they invest the policies they collect in securities. Investment bankers who broker M&A deals are on the sell-side, regardless of whether they represent the company that's being taken over (sell-side?) or the raider company (the one that's looking to 'buy').

TheStreet.com says:

" Sell-side firms are what people traditionally think of when looking for Wall Street jobs. These firms underwrite securities and advise on mergers and acquisitions through their corporate finance divisions. Their sales and trading divisions make secondary markets in a variety of securities, including stocks, bonds, currencies, swaps, commodities and derivatives. Analysts in research divisions make both macro (overall investment strategy) and micro (company-specific) recommendations.

Buy-side firms generally manage portfolios on behalf of clients. They include insurance companies like Aetna, investment management firms like Wellington Management, mutual fund companies like Fidelity and hedge funds like Moore Capital."

A clearer definition (I think) is this: the key is to think of basic financial instruments (stocks, bonds and the like). Buy-side firms (such as mutual funds) invest in these financial instruments. Sell-side firms sell these - for example, investment banks may underwrite a company's IPO, or help to sell the company's shares to the public (and take a cut).

Though the definition seems clear-cut, its not always this simple.

Where do commercial banks stand (they take deposits and issue loans)? They invest the deposits by buying securities - so buy-side? Or maybe - because they issue bank loans, a form of financing- sell-side? Officially, they're on the buy side.

Insurance companies sell what might be called a financial instrument, but they fall on the buy-side because they invest the policies they collect in securities. Investment bankers who broker M&A deals are on the sell-side, regardless of whether they represent the company that's being taken over (sell-side?) or the raider company (the one that's looking to 'buy').

Sunday, October 15, 2006

Finance, Economics, and Peace

Congratulations to the pioneering 'microfinance' practitioner, Bangladeshi Dr. Muhammad Yunus, for winning the Nobel Peace Prize on Friday. Dr. Yunus is a PhD in Economics and won the prize for his founding of Grameen Bank, which lends to small entrepreneurs at reasonable rates of interest in order to finance their small businesses.

Certainly he has taken important steps towards helping the poorest people to become self-sufficient and to prevent their being taken advantage of by unscrupulous money lenders.

But the Peace Prize?

At first glance, it is hard to equate philanthropic work or finance innovation with an award for peace. The peace prize after all has historically been awarded to international figures who try to broker peace between warring factions:

The Intl. Atomic Energy Agency last year, and previously activist for women's issues and refugees Shirin Ebadi, the United Nations and Doctors Without Borders.

To make matters more dubious in my eyes, the Nobel Committee specifically introduced the Islam motif in their award speech with the statement "Here we see a Muslim influencing the rest of the world" (presumably they also meant "in a positive way").

In my view the introduction of this religious theme into what should be a nonsectarian recognition of the greatest human effort to promote peace was quite unnecessary. More so when one realizes that Grameen Bank does not have particular claims to Islam - in fact, its basic premise, lending with interest, is completely at odds with the first principles of Islamic finance. (Islamic finance forbids lenders from charging interest).

If raising the quality of life for the poorest sections of the world is a basis for awarding the Peace Prize (and I'm not disagreeing, certainly it is a worthwhile effort that should be recognized, and certainly it does not fit into any of the other Nobel categories)- and Doctors Without Borders, an organization I have immense awe for, could certainly fit under this head - perhaps Bill and Melinda Gates should be contenders. Their Foundation, which is probably the largest of its kind in the world, especially after the recent additions by Warren Buffett, contributing the equivalent of many small countries' fortunes annually to various charitable causes.

In comparison with what they do for the world's underpriveleged, Muhammad Yunus is merely a businessman and economist who started a bank with an innovative lending policy.

Certainly he has taken important steps towards helping the poorest people to become self-sufficient and to prevent their being taken advantage of by unscrupulous money lenders.

But the Peace Prize?

At first glance, it is hard to equate philanthropic work or finance innovation with an award for peace. The peace prize after all has historically been awarded to international figures who try to broker peace between warring factions:

The Intl. Atomic Energy Agency last year, and previously activist for women's issues and refugees Shirin Ebadi, the United Nations and Doctors Without Borders.

To make matters more dubious in my eyes, the Nobel Committee specifically introduced the Islam motif in their award speech with the statement "Here we see a Muslim influencing the rest of the world" (presumably they also meant "in a positive way").

In my view the introduction of this religious theme into what should be a nonsectarian recognition of the greatest human effort to promote peace was quite unnecessary. More so when one realizes that Grameen Bank does not have particular claims to Islam - in fact, its basic premise, lending with interest, is completely at odds with the first principles of Islamic finance. (Islamic finance forbids lenders from charging interest).

If raising the quality of life for the poorest sections of the world is a basis for awarding the Peace Prize (and I'm not disagreeing, certainly it is a worthwhile effort that should be recognized, and certainly it does not fit into any of the other Nobel categories)- and Doctors Without Borders, an organization I have immense awe for, could certainly fit under this head - perhaps Bill and Melinda Gates should be contenders. Their Foundation, which is probably the largest of its kind in the world, especially after the recent additions by Warren Buffett, contributing the equivalent of many small countries' fortunes annually to various charitable causes.

In comparison with what they do for the world's underpriveleged, Muhammad Yunus is merely a businessman and economist who started a bank with an innovative lending policy.

"How does corporate governance even matter?" The bottom line..

Suppose the CFO or CEO of a company asks you the above question.

Forget value judgements and moral righteousness.

How would you convince the CFO/CEO that good corporate governance is worth the cost?

The carrots:

1. Corporate governance affects bond ratings

Bhojraj and Sengupta as well as Ashbaugh, Collins and LaFond have made arguments to that effect.

2. And therefore affects cost of capital

See above; as well as Gompers Ishii and Metrick's paper entitled Corporate Governance and the Cost of Equity Capital.

3. Corporate governance affects share price

4. Institutional investors' demand for a stock may depend on governance

5. Better compensation structure may result from stronger governance

Davila and Penalva found that stronger corporate governance is associated with higher proportion of equity in a CEO’s compensation package.

6. Governance may directly affect firm performance

Brown and Caylor found that seven of the metrics utilized by Institutional Shareholder Services (ISS), principally those related to director performance and senior management stock options, had an effect on firm performance. Bebchuk Cohen and Ferrell find that the entrenchment index (developed from six ISS corporate governance variables) improves firm performance.

And the stick:

5. Poor corporate governance can result in executives' employment termination

More on these individual issues (and more links to papers and findings) coming up.

Forget value judgements and moral righteousness.

How would you convince the CFO/CEO that good corporate governance is worth the cost?

The carrots:

1. Corporate governance affects bond ratings

Bhojraj and Sengupta as well as Ashbaugh, Collins and LaFond have made arguments to that effect.

2. And therefore affects cost of capital

See above; as well as Gompers Ishii and Metrick's paper entitled Corporate Governance and the Cost of Equity Capital.

3. Corporate governance affects share price

4. Institutional investors' demand for a stock may depend on governance

5. Better compensation structure may result from stronger governance

Davila and Penalva found that stronger corporate governance is associated with higher proportion of equity in a CEO’s compensation package.

6. Governance may directly affect firm performance

Brown and Caylor found that seven of the metrics utilized by Institutional Shareholder Services (ISS), principally those related to director performance and senior management stock options, had an effect on firm performance. Bebchuk Cohen and Ferrell find that the entrenchment index (developed from six ISS corporate governance variables) improves firm performance.

And the stick:

5. Poor corporate governance can result in executives' employment termination

More on these individual issues (and more links to papers and findings) coming up.

Out of hibernation

Hello readers!

I am back after some prodding by my faithful readers and friends, after a long hiatus.

My bad. No excuses.

Much has happened in the corporate governance news in the meantime. The options backdating issue has snowballed into a scandal of epic proportions. The resultant spotlight has brought various other governance lapses of companies to public view, prominent among which is the H-P directors snafu that resulted in the resignation of chairperson Patricia Dunn. Executive pay continues to be a concern.

Your opinions on these and other events are, as always, welcome.

And mine, as before, will be forthcoming.

I am back after some prodding by my faithful readers and friends, after a long hiatus.

My bad. No excuses.

Much has happened in the corporate governance news in the meantime. The options backdating issue has snowballed into a scandal of epic proportions. The resultant spotlight has brought various other governance lapses of companies to public view, prominent among which is the H-P directors snafu that resulted in the resignation of chairperson Patricia Dunn. Executive pay continues to be a concern.

Your opinions on these and other events are, as always, welcome.

And mine, as before, will be forthcoming.

Sunday, July 02, 2006

Securities litigation: top ten settlements

Ten largest settlements in securities class action lawsuits: (in millions)

Rank Issuer Settlement amount Percentage of Valuation

1 Enron $7,160.50 21.12%

2 WorldCom $6,156.30 18.16%

3 Cendant $3,528.00 10.41%

4 AOL Time Warner $2,500.00 7.37%

5 Nortel Networks $2,473.60 7.30%

6 Royal Ahold $1,091.00 3.22%

7 IPO Allocation Lit. $1,000.00 2.95%

8 McKesson HBOC $960.00 2.83%

9 Lucent Technologies $673.40 2.19%

10 Bristol-Myers Squibb $574.00 1.69%

All other large settlements $7,786.50 22.97%

Source: Stanford Securities Class Action Database jointly maintained by Cornerstone Research.

Rank Issuer Settlement amount Percentage of Valuation

1 Enron $7,160.50 21.12%

2 WorldCom $6,156.30 18.16%

3 Cendant $3,528.00 10.41%

4 AOL Time Warner $2,500.00 7.37%

5 Nortel Networks $2,473.60 7.30%

6 Royal Ahold $1,091.00 3.22%

7 IPO Allocation Lit. $1,000.00 2.95%

8 McKesson HBOC $960.00 2.83%

9 Lucent Technologies $673.40 2.19%

10 Bristol-Myers Squibb $574.00 1.69%

All other large settlements $7,786.50 22.97%

Source: Stanford Securities Class Action Database jointly maintained by Cornerstone Research.

Monday, June 19, 2006

Freddie vs. Fannie

I was asked the other day (by a rather nice person) what the difference was between Freddie Mac and Fannie Mae. I didn't know. Hence this post (after some googling, of course).

This article from the Real Estate department at Texas A&M says:

I actually interviewed for an economist position with Freddie Mac before I took up my current position. They have a good research team (and excellent benefits!), but the job profile with its concentration in economics (not finance and certainly not corporate finance) wasn't such a fit with my research interests.

This article from the Real Estate department at Texas A&M says:

At first, the two agencies took somewhat distinctive positions within the secondary mortgage market, buying different types of loans and issuing different types of securities. Today, however, there is little difference in the way the two operate or raise funds. Fannie Mae is perceived as more governmental than Freddie Mac, possibly because it is a more vocal advocate of its public mission.

I actually interviewed for an economist position with Freddie Mac before I took up my current position. They have a good research team (and excellent benefits!), but the job profile with its concentration in economics (not finance and certainly not corporate finance) wasn't such a fit with my research interests.

Sunday, June 18, 2006

Fannie Mae and the Wiki: Or, Am I being picky?

Check out Fannie Mae's Wikipedia entry. After describing what Fannie Mae does (a good description if you're not quite sure) it goes on to say:

I dont like to pick on Fannie Mae, but it probably this very notion of Fannie Mae being 'consistently profitable' that the company managers were reluctant to give up. And that probably explains (but does not excuse) why Fannie Mae, which experienced major losses as mortgage rates dropped, avoided recording the losses as such. Instead, they were hidden in the balance sheet under AOCI, or "accumulated other comprehensive income" and slowly amortized.

Wikipedia goes on to report the latest events (and I quote) :

Fannie Mae is a consistently profitable corporation. While it receives no direct government funding or backing, it has certain looser restrictions placed on its activities than normal financial institutions. For example, it is allowed to sell mortgage backed securities with half the capital backing them up than is required by other financial institutions. Critics, including Alan Greenspan, say that this is only allowed because investors seem to think that there is a hidden, or implied, guarantee to the bonds that Fannie Mae sells ([2]). Although the company describes them as having no guarantee, nevertheless the vast majority of investors believe that the Government would prevent them from defaulting on their debt, and so buy bonds at very low interest rates as compared to others having like risk.

I dont like to pick on Fannie Mae, but it probably this very notion of Fannie Mae being 'consistently profitable' that the company managers were reluctant to give up. And that probably explains (but does not excuse) why Fannie Mae, which experienced major losses as mortgage rates dropped, avoided recording the losses as such. Instead, they were hidden in the balance sheet under AOCI, or "accumulated other comprehensive income" and slowly amortized.

Wikipedia goes on to report the latest events (and I quote) :

In May 2006, the Office of Federal Housing Enterprise Oversight released a detailed report on the scandal, alleging Fannie Mae management fraudulently altered the company's accounting to overstate earnings to boost their personal bonuses. The report also alleges the company hired lobbyists to attempt to get Congress to investigate OFHEO and cut its budget, to hide the misdeeds. Fannie Mae agreed to pay $400 million in penalties. The company's market capitalization droped by $9 billion as a result of the scandal. As of May 2006, no criminal charges have been filed, but the investigation is ongoing.

Friday, June 16, 2006

Changes at Fannie Mae and looking back in time

MarketWatch has an interesting article about changes at Fannie Mae following "the company's foundation-shaking $10 billion accounting scandal."

Fannie Mae's accounting scandal that recently came to light involves allegations of manipulation to hide massive losses in 2002 and 2003.

Take a look, then, at this article written in early 2003 that mentions Fannie Mae's high corporate governance score awarded by S&P at the time! Here's an excerpt:

Oh, the irony !

" (CEO) Mudd has explained repeatedly to investors and lawmakers that he's trying to clean up Fannie, which is chartered by the government, but publicly traded.

On Thursday, Mudd told senators the company replaced its onsite auditors and has more than 300 auditors overseeing the firm's books. He said he and his management team are reorganizing Fannie's internal audit department. There's a new chief audit executive, with a direct line to the board's audit committee, he said.

The company will complete the massive restatement of earnings by year-end, Mudd said Thursday.

(But) James Lockhart, head of the Office of Federal Housing Enterprise Oversight, told lawmakers that Fannie Mae and Freddie Mac have a "very, very long way to go" to correct internal accounting control problems. Neither of the agencies, said Lockhart, is "even close to complying with Sarbanes-Oxley," referring to the corporate governance law passed in 2002. "

Fannie Mae's accounting scandal that recently came to light involves allegations of manipulation to hide massive losses in 2002 and 2003.

Take a look, then, at this article written in early 2003 that mentions Fannie Mae's high corporate governance score awarded by S&P at the time! Here's an excerpt:

Fannie Mae (ticker: FNM), the government-mandated mortgage broker, earned an overall CGS of 9.0 on a 10-point scale, reflecting "strong or very strong" corporate governance practices in all four of the areas analyzed.

..S&P Governance Services applauded the structure of Fannie Mae's board of directors, which meets the rules recently proposed by the New York Stock Exchange (NYSE). S&P also praised the board's independence.

"Our standard is to be a model 'glass box' company," said Mr. Raines (Fannie Mae CEO/Chair Franklin Raines). "And as the record shows, we are always willing to do more to keep our disclosures and corporate governance at the cutting-edge of best practices."

Oh, the irony !

Microsoft forward dated option awards... even to directors!

..and yet they didnt think to question the practice?!

Well, I suppose we should give them a break. Somebody must have raised some objections, because they abandoned the system in the late 1990s.

For those still confused about backdating vs. forward dating, here's the deal:

Say on June 1st, company X decides to give an employee stock options. Ideally, they should award the options with an exercise price thats equal to the stock price on June 1st.

The companies involved in the backdating scandal however, picked a date which had the lowest stock price in the previous quarter (or year, or month) and awarded it retrospectively on that date - say, May 4th.

Microsoft, however, after deciding to award the stock options to the employee on June 1st, goes on to wait and see for the next 30 days. Then it awarded the option with an exercise price equal to the lowest stock price in the next 30 days - say, on June 13th. Hence "forward" dating.

Whats the difference? A Microsoft spokesperson in an article today claimed that there was nothing wrong with what they did. However, lets examine the incentives at work here.

The employee at Company X was happy to receive a stock option which locked in an instant gain on the day he received it. This did not motivate him to work hard enough in the next year or so, because the locked-in gains were substantial as it is and unlikely to get much larger.

The employee at Microsoft, however, from June 1st onwards, was probably constantly looking for the stock price to DROP in the next 30 days (though of course he would look for the price to rise again subsequent to the 30 days). One may say that this in fact gives the employee a conflict of interest with the company!

Instead of simply being not motivated to work hard for the company (like employee X), the Microsoft guy's incentives were aligned to profit him if the company does poorly in the first 30 days !

So contrary to Microsoft's claim that they 'did nothing wrong' I would say that their actions were far more harmful to the company than the actions of all the (45 plus?) companies involved in the backdating probe.The only redeeming factor about MS being that the practice was stopped soon after it was begun in the 1990s.

Well, I suppose we should give them a break. Somebody must have raised some objections, because they abandoned the system in the late 1990s.

For those still confused about backdating vs. forward dating, here's the deal:

Say on June 1st, company X decides to give an employee stock options. Ideally, they should award the options with an exercise price thats equal to the stock price on June 1st.

The companies involved in the backdating scandal however, picked a date which had the lowest stock price in the previous quarter (or year, or month) and awarded it retrospectively on that date - say, May 4th.

Microsoft, however, after deciding to award the stock options to the employee on June 1st, goes on to wait and see for the next 30 days. Then it awarded the option with an exercise price equal to the lowest stock price in the next 30 days - say, on June 13th. Hence "forward" dating.

Whats the difference? A Microsoft spokesperson in an article today claimed that there was nothing wrong with what they did. However, lets examine the incentives at work here.

The employee at Company X was happy to receive a stock option which locked in an instant gain on the day he received it. This did not motivate him to work hard enough in the next year or so, because the locked-in gains were substantial as it is and unlikely to get much larger.

The employee at Microsoft, however, from June 1st onwards, was probably constantly looking for the stock price to DROP in the next 30 days (though of course he would look for the price to rise again subsequent to the 30 days). One may say that this in fact gives the employee a conflict of interest with the company!

Instead of simply being not motivated to work hard for the company (like employee X), the Microsoft guy's incentives were aligned to profit him if the company does poorly in the first 30 days !

So contrary to Microsoft's claim that they 'did nothing wrong' I would say that their actions were far more harmful to the company than the actions of all the (45 plus?) companies involved in the backdating probe.The only redeeming factor about MS being that the practice was stopped soon after it was begun in the 1990s.

Monday, June 12, 2006

Backdating companies count

I feel like I should have a counter constantly updating the number of companies that have been caught in the backdating scandal. The current hit counter is 40.

Wow. Even with this many companies (and more) that were doing it, nobody spoke up? Where are all the whistle blowers gone?

Wow. Even with this many companies (and more) that were doing it, nobody spoke up? Where are all the whistle blowers gone?

Brief hiatus

I will be out of town for the next 5 days or so with little access to the web. But I will be back and posting regularly from next week. Sorry for the interruption!

Tuesday, June 06, 2006

Recouping executive bonuses

GM shareholders were not the first ones to think about recouping executive performance bonuses based on falsely inflated financials (see previous post). When financials are restated, bonuses based on the wrong figures should be revised downwards and the company should recoup the excess amounts paid.

* Shareholders at another company, Kodak, tried (and failed) to make this change at their meeting last month. The Amalgamated Bank LongView Collective Investment Fund, a shareholder, wanted Kodak's board to commit to reviewing and recouping executive bonuses and other rewards in the event of an earnings restatement. However this resolution failed to pass.

* Shareholders at HP, also in May 2006, submitted (but failed to pass) a resolution seeking to allow the company to recoup bonuses after earnings restatements.

* When the Office of Federal Housing Enterprise Oversight released a report of their investigation into Fannie Mae's (suspiciously) growing earnings from 1998 until 2004, it prompted some talk about trying to recoup some of the performance-based bonuses from executives, such as former Chairman Franklin Raines. Of $90 million Raines received from the company between 1998 and 2003, $52 million was tied to earnings targets that the company hit, at least in part, by "deliberately and intentionally" manipulating its accounting, investigators concluded (story here).

But no steps have been taken as yet.

And since this blog is all about connecting academic research with real-world issues, I looked to see if there is any academic work about recovering executive pay or bonuses after restatements.

Zip. Zilch. Nothing.

Ideas, anyone?

* Shareholders at another company, Kodak, tried (and failed) to make this change at their meeting last month. The Amalgamated Bank LongView Collective Investment Fund, a shareholder, wanted Kodak's board to commit to reviewing and recouping executive bonuses and other rewards in the event of an earnings restatement. However this resolution failed to pass.

* Shareholders at HP, also in May 2006, submitted (but failed to pass) a resolution seeking to allow the company to recoup bonuses after earnings restatements.

* When the Office of Federal Housing Enterprise Oversight released a report of their investigation into Fannie Mae's (suspiciously) growing earnings from 1998 until 2004, it prompted some talk about trying to recoup some of the performance-based bonuses from executives, such as former Chairman Franklin Raines. Of $90 million Raines received from the company between 1998 and 2003, $52 million was tied to earnings targets that the company hit, at least in part, by "deliberately and intentionally" manipulating its accounting, investigators concluded (story here).

But no steps have been taken as yet.

And since this blog is all about connecting academic research with real-world issues, I looked to see if there is any academic work about recovering executive pay or bonuses after restatements.

Zip. Zilch. Nothing.

Ideas, anyone?

GM shareholders initiate some changes; and an important issue comes to light

Today was the GM shareholder meeting in which shareholders voted on various resolutions.

Three of the four resolutions strongly backed by ISS(Institutional Shareholder Services, one of the big proponents of good governance)were passed. These proposals are:

- A proposal asking the company to separate the chairman and chief executive positions;

- a proposal requiring a majority vote for election of directors; and

- a proposal asking the company to provide for cumulative voting.

A fourth proposal strongly backed by ISS was not passed. This was a proposal to recoup executive compensation that may not have been correctly earned in the light of financial restatements. The proposal argues that due to financial restatements in the 2000 through 2004 period, executive compensation based on financial performance was flawed and overpaid.

This is an important issue that has been largely ignored, and also crops up in other contexts. When companies overstate their financials, and this is subsequently corrected, the company often has to pay a penalty for their poor reporting. But rarely are executive bonuses paid on the basis of the misreported high financials reimbursed.

This issue may also arise in two other situations, both when the SEC investigates improper reporting and imposes fines upon the company; and when civil litigation penalizes a company for improper litigation. In both cases, the company/shareholders pay the penalty, but executives get to keep their undue gains.

More on this issue in the next post.

Three of the four resolutions strongly backed by ISS(Institutional Shareholder Services, one of the big proponents of good governance)were passed. These proposals are:

- A proposal asking the company to separate the chairman and chief executive positions;

- a proposal requiring a majority vote for election of directors; and

- a proposal asking the company to provide for cumulative voting.

A fourth proposal strongly backed by ISS was not passed. This was a proposal to recoup executive compensation that may not have been correctly earned in the light of financial restatements. The proposal argues that due to financial restatements in the 2000 through 2004 period, executive compensation based on financial performance was flawed and overpaid.

This is an important issue that has been largely ignored, and also crops up in other contexts. When companies overstate their financials, and this is subsequently corrected, the company often has to pay a penalty for their poor reporting. But rarely are executive bonuses paid on the basis of the misreported high financials reimbursed.

This issue may also arise in two other situations, both when the SEC investigates improper reporting and imposes fines upon the company; and when civil litigation penalizes a company for improper litigation. In both cases, the company/shareholders pay the penalty, but executives get to keep their undue gains.

More on this issue in the next post.

Monday, June 05, 2006

What is 'Corporate Governance law' ?

From the website of law firm Weil, Gotshal and Manges, awarded the title of 'Global Corporate Governance law firm of the year' both in 2005 and 2006 by Who's Who Legal:

Weil Gotshal's Securities/Corporate Governance Litigation practice addresses the increasingly complex web of federal and state statutes, rules, common law and regulatory oversight of public and private organizations, from both the litigation and counseling perspectives.

This practice includes not only class action, "mass action," bankruptcy and other private litigation, but also civil regulatory and criminal proceedings under federal and state securities laws; shareholder derivative and other corporate/partnership governance and fiduciary duty disputes; and litigation involving complex corporate transactions.

Equally important, the other focus of this practice involves counseling issuers, boards of directors, audit committees, and other standing or special board committees and significant shareholder or securities industry constituencies, on issues involving disclosure and other securities law compliance and on issues of corporate governance (including internal investigations) and fiduciary duties under state and federal law.

Weil Gotshal's Securities/Corporate Governance Litigation practice addresses the increasingly complex web of federal and state statutes, rules, common law and regulatory oversight of public and private organizations, from both the litigation and counseling perspectives.

This practice includes not only class action, "mass action," bankruptcy and other private litigation, but also civil regulatory and criminal proceedings under federal and state securities laws; shareholder derivative and other corporate/partnership governance and fiduciary duty disputes; and litigation involving complex corporate transactions.

Equally important, the other focus of this practice involves counseling issuers, boards of directors, audit committees, and other standing or special board committees and significant shareholder or securities industry constituencies, on issues involving disclosure and other securities law compliance and on issues of corporate governance (including internal investigations) and fiduciary duties under state and federal law.

Governance guidelines, anyone?

I came across the National Association of Corporate Directors website that contains a good summary of some generally accepted governance guidelines (GAGG?) put out by several different organizations.

Jokes aside, this is a good go-to site for looking up relevant rules and guidelines. Here's a list:

Corporate Governance Codes and Practices in the New Era of Corporate Accountability

Sarbanes-Oxley Act of 2002 (PDF, 130 pages, 680Kb)

Sarbanes-Oxley Act of 2002 Imposes New Rules for Corporate Governance and Reporting (Weil, Gotshal & Manges LLP. - September 2002)

New York Stock Exchange (NYSE) -- Filing of Proposed Rule Change and Amendment -- http://www.sec.gov/rules/sro/34-47672.htm

NASDAQ - Summary of proposed corporate governance reforms -- http://www.nasdaq.com/about/Web_Corp_Gov_Summary%20Feb-revised.pdf

AMEX - Enhanced Corporate Governance and proposed rule changes --http://www.amex.com/?href=/atamex/news/am_corgov.htm

National Association of Corporate Directors (NACD) - Recommendations for Reform post-Enron

Organisation for Economic Cooperation & Development (OECD) - OECD Principles of Corporate Governance (PDF, 42 pages)

The Business Roundtable (BRT) - Principles of Corporate Governance (PDF, 37 pages)

Council of Institutional Investors (CII) - Corporate Governance Policies

TIAA-CREF Policy Statement on Corporate Governance - http://www4.tiaa-cref.org/libra/governance/index.html

CalPERS Governance Principles -- http://www.calpers-governance.org/principles/default.asp

The World Bank - Corporate Governance Principles of Best Practices -- http://www.worldbank.org/html/fpd/privatesector/cg/codes.htm

Comparison of Corporate Governance Guidelines and Codes of Best Practice: United States - Source: Weil Gotshal and Manges, 2003

Jokes aside, this is a good go-to site for looking up relevant rules and guidelines. Here's a list:

Corporate Governance Codes and Practices in the New Era of Corporate Accountability

Sarbanes-Oxley Act of 2002 (PDF, 130 pages, 680Kb)

Sarbanes-Oxley Act of 2002 Imposes New Rules for Corporate Governance and Reporting (Weil, Gotshal & Manges LLP. - September 2002)

New York Stock Exchange (NYSE) -- Filing of Proposed Rule Change and Amendment -- http://www.sec.gov/rules/sro/34-47672.htm

NASDAQ - Summary of proposed corporate governance reforms -- http://www.nasdaq.com/about/Web_Corp_Gov_Summary%20Feb-revised.pdf

AMEX - Enhanced Corporate Governance and proposed rule changes --http://www.amex.com/?href=/atamex/news/am_corgov.htm

National Association of Corporate Directors (NACD) - Recommendations for Reform post-Enron

Organisation for Economic Cooperation & Development (OECD) - OECD Principles of Corporate Governance (PDF, 42 pages)

The Business Roundtable (BRT) - Principles of Corporate Governance (PDF, 37 pages)

Council of Institutional Investors (CII) - Corporate Governance Policies

TIAA-CREF Policy Statement on Corporate Governance - http://www4.tiaa-cref.org/libra/governance/index.html

CalPERS Governance Principles -- http://www.calpers-governance.org/principles/default.asp

The World Bank - Corporate Governance Principles of Best Practices -- http://www.worldbank.org/html/fpd/privatesector/cg/codes.htm

Comparison of Corporate Governance Guidelines and Codes of Best Practice: United States - Source: Weil Gotshal and Manges, 2003

Saturday, June 03, 2006

Stolt-Nielsen also backdated options

From the WSJ:

In an annual report filed with the Securities and Exchange Commission, Stolt described the granting of options in two prior years as a "material weakness" in its accounting practices. The company says it corrected the problem last year after it was flagged during an internal review of financial controls.

Thursday, May 25, 2006

Backdating option grants: Directors' responsibility

Is the current backdating scandal a result of director negligence or director complicity?

Before Comverse announced its internal probe, John Friedman, a member of the board's compensation committee, said directors had noticed the scattered nature of the grants -- eight between 1994 and 2001 fell in six different months -- but management assured them there were valid reasons.

This week, Comverse said that, as a result of the board's review of its options grants, it expects it will need to restate past financial results.

Before Comverse announced its internal probe, John Friedman, a member of the board's compensation committee, said directors had noticed the scattered nature of the grants -- eight between 1994 and 2001 fell in six different months -- but management assured them there were valid reasons.

This week, Comverse said that, as a result of the board's review of its options grants, it expects it will need to restate past financial results.

Quotable Quote

Backdating "represents the ultimate in greed," says Arthur Levitt, a former chairman of the Securities and Exchange Commission. "It is stealing, in effect. It is ripping off shareholders in an unconscionable way."

Breaking the law: Breaking news

As more news breaks about companies suspected or investigated in connection with options backdating, it may be useful to maintain (and keep updating) a list of companies that have come under fire.

Here's a quick-reference list! (Sources: WSJ articles and other newspapers. Please let me know if any dates are off.)

Company Date implicated Who initiated itAnalog Devices Fall 2005 SEC

Mercury Interactive 1-Nov-05 Company

Affiliated Computer

Services 18-Mar-06 WSJ

Brooks Automation 18-Mar-06 WSJ

Comverse Technology 18-Mar-06 WSJ

Jabil Circuit 18-Mar-06 WSJ

United Health 18-Mar-06 WSJ

Vitesse Semiconductor 18-Mar-06 WSJ

Power Integrations 5-May-06 Company?

Altera Corp. 8-May-06 Company

Caremark Rx 18-May-06 SEC, Grand Jury

SafeNet 18-May-06 US Attorney, SEC

Semtech 18-May-06 SEC

Nyfix 19-May-06 US Attorney

Sycamore Networks 19-May-06 SEC

RSA Security 19-May-06 SEC

Boston Communications

Group 22-May-06 WSJ

CNET Networks 22-May-06 WSJ, then SEC

F5 Networks 22-May-06 SEC, Grand Jury

Juniper Networks 22-May-06 US Attorney

KLA Tencor 22-May-06 WSJ

Meade Instruments 22-May-06 WSJ

Openwave Systems 22-May-06 SEC

Quest Software 22-May-06 Company

Renal Care Group 22-May-06 WSJ

Trident Microsystems 22-May-06 WSJ

Medarex Inc. 24-May-06 SEC

Here's a quick-reference list! (Sources: WSJ articles and other newspapers. Please let me know if any dates are off.)

Company Date implicated Who initiated itAnalog Devices Fall 2005 SEC

Mercury Interactive 1-Nov-05 Company

Affiliated Computer

Services 18-Mar-06 WSJ

Brooks Automation 18-Mar-06 WSJ

Comverse Technology 18-Mar-06 WSJ

Jabil Circuit 18-Mar-06 WSJ

United Health 18-Mar-06 WSJ

Vitesse Semiconductor 18-Mar-06 WSJ

Power Integrations 5-May-06 Company?

Altera Corp. 8-May-06 Company

Caremark Rx 18-May-06 SEC, Grand Jury

SafeNet 18-May-06 US Attorney, SEC

Semtech 18-May-06 SEC

Nyfix 19-May-06 US Attorney

Sycamore Networks 19-May-06 SEC

RSA Security 19-May-06 SEC

Boston Communications

Group 22-May-06 WSJ

CNET Networks 22-May-06 WSJ, then SEC

F5 Networks 22-May-06 SEC, Grand Jury

Juniper Networks 22-May-06 US Attorney

KLA Tencor 22-May-06 WSJ

Meade Instruments 22-May-06 WSJ

Openwave Systems 22-May-06 SEC

Quest Software 22-May-06 Company

Renal Care Group 22-May-06 WSJ

Trident Microsystems 22-May-06 WSJ

Medarex Inc. 24-May-06 SEC

Monday, May 22, 2006

Backdating of stock options: SEC probe triggered by academic papers

In yet another instance where academic research has alerted the SEC to take action against potentially illegal activities, research by Dr. Erik Lie at Iowa and Dr. Yermack at Stern led to the uncovering of the recent options backdating scandal.

If you know what options backdating is all about, skip this paragraph and go to the next one. For the benefit of readers who don't, here's a short summary. Employee stock options to buy shares at a preset "strike" price became a widespread form in the last 15 years or so. Recently, investigations have found that companies artificially set the grant date of these options to a day on which stock prices have been at a low ebb, thereby assuring executives of a fat profit on the day they are granted. By tying strike prices to earlier, more favorable dates, executives granted options can instantly lock in a paper gain -- and, if a stock goes up, increase their real gain when they exercise them. This defeats the incentive effect of employee stock options, which is to reward the executive only when their contributions result in a stock price increase. In the words of Dr. David Yermack, "The whole point of a stock option (as an incentive mechanism) is that you only profit if the stock goes up. If you fix it in advance so that it's already deep in the money, it eliminates a lot of the risk."

News sources including this one credit the discovery of this manipulation to Dr. Erik Lie and other academic researchers.

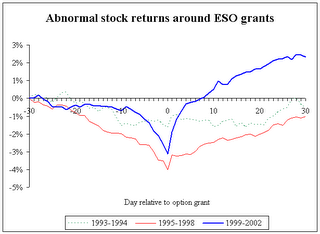

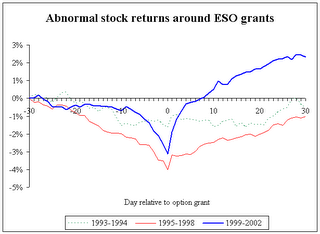

A great, simple explanation of this topic is found at Professor Lie's website here. The following graph from his website provides a good illustration of the magnitude of this problem, as the effect appears strong even after averaging over thousands of companies.

The latest developments including a timeline of options investigations, and the list of companies that have been caught backdating options are succinctly summarized in these WSJ articles.

If you know what options backdating is all about, skip this paragraph and go to the next one. For the benefit of readers who don't, here's a short summary. Employee stock options to buy shares at a preset "strike" price became a widespread form in the last 15 years or so. Recently, investigations have found that companies artificially set the grant date of these options to a day on which stock prices have been at a low ebb, thereby assuring executives of a fat profit on the day they are granted. By tying strike prices to earlier, more favorable dates, executives granted options can instantly lock in a paper gain -- and, if a stock goes up, increase their real gain when they exercise them. This defeats the incentive effect of employee stock options, which is to reward the executive only when their contributions result in a stock price increase. In the words of Dr. David Yermack, "The whole point of a stock option (as an incentive mechanism) is that you only profit if the stock goes up. If you fix it in advance so that it's already deep in the money, it eliminates a lot of the risk."

News sources including this one credit the discovery of this manipulation to Dr. Erik Lie and other academic researchers.

"A study, by Erik Lie, a finance professor at the University of Iowa's business school, looked at thousands of option grants. On average, he found a pattern of stocks dipping sharply just before the date of option grants, then rising immediately afterward -- even after adjusting for overall market returns. Equally striking, he found market prices as a whole tended to rise after grants -- which he suggested shows that executives may have backdated options, already knowing how the market moved.

A second study, by Prof. Lie and Randall Heron of Indiana University's business school, showed the patterns all but ceased after August 2002, when rules put in place by the Sarbanes-Oxley corporate-reform law began requiring executives to report option grants to regulators within two days, instead of the weeks or months previously allowed. With less leeway to choose a favorable grant date, "most of the effect disappeared," said Prof. Lie."

A great, simple explanation of this topic is found at Professor Lie's website here. The following graph from his website provides a good illustration of the magnitude of this problem, as the effect appears strong even after averaging over thousands of companies.

The latest developments including a timeline of options investigations, and the list of companies that have been caught backdating options are succinctly summarized in these WSJ articles.

Sunday, May 21, 2006

Back to regular posting!

Sorry for the long absence of posts, I'm back to regular posting. Please check in every day!

Wednesday, May 10, 2006

SOX rocks

A study by Lord & Benoit LLC finds that companies that have implemented internal checks and controls as required by Sarbanes-Oxley legislation (SOX) are rewarded by market-beating stock returns.

Further, even companies that perform internal checks, find irregularities, and correct them are rewarded by strong stock performance.

The full article is here.

This is not Lord & Benoit's first SOX study. An earlier study released in April concluded that that "the statistics raise questions" on whether small-cap and micro-cap companies can be relied upon to self-report material weaknesses in internal controls. Section 302 of the Sarbanes-Oxley law requires companies to self-report disclosure controls and requirements in internal controls.

Said Robert Benoit, president and director of SOX Research for Lord & Benoit, and author of the report, "From an ethical perspective, the report shows only 8 percent to 14 percent of the accelerated filers with material weaknesses self-reported their weaknesses. It was not until Section 404 that they were forthcoming. This kind of data makes me wonder."

Benoit added that about 50 of the companies studied had unethical behaviors, such as fraudulent reporting, employee fraud, Securities and Exchange Commission investigations, and accounting irregularities and misrepresentations.

Read more here.

Further, even companies that perform internal checks, find irregularities, and correct them are rewarded by strong stock performance.

The full article is here.

This is not Lord & Benoit's first SOX study. An earlier study released in April concluded that that "the statistics raise questions" on whether small-cap and micro-cap companies can be relied upon to self-report material weaknesses in internal controls. Section 302 of the Sarbanes-Oxley law requires companies to self-report disclosure controls and requirements in internal controls.

Said Robert Benoit, president and director of SOX Research for Lord & Benoit, and author of the report, "From an ethical perspective, the report shows only 8 percent to 14 percent of the accelerated filers with material weaknesses self-reported their weaknesses. It was not until Section 404 that they were forthcoming. This kind of data makes me wonder."

Benoit added that about 50 of the companies studied had unethical behaviors, such as fraudulent reporting, employee fraud, Securities and Exchange Commission investigations, and accounting irregularities and misrepresentations.

Read more here.

Verizon's reduction in CEO pay to deflect criticism

Verizon has substantially reduced pay of its CEO in anticipation of shareholder criticism.

From the WSJ news item:

From the WSJ news item:

"Last year, Verizon's board granted a long-term stock incentive package to Chief Executive Ivan Seidenberg that would have increased his 2005 compensation 50% from the year before to nearly $27 million. This past March, directors abruptly canceled a big chunk of that grant, initially valued at $7.6 million, before the increase had been widely publicized. The board acted -- with Mr. Seidenberg's approval -- amid concern about how shareholders would react to giving him a big raise after Verizon's stock had dropped 25% in 2005."

Friday, May 05, 2006

Newest executive pay issue: dividends on unvested restricted stock

An article in the WSJ today throws light on yet another murky executive pay practice. The recent furore regarding stock options has resulted in many companies opting to compensate their executives through restricted stock instead. Restrictive stock is in general a better way to align incentives as it is paid out only if the company meets certain performance targets. However, many companies pay dividends to executives on these unvested restricted stock, i.e. stock which the executives dont even own! They may own the stock in the future IF the performance targets are met, but they are paid dividends today.

The full article is here.

New SEC rules will require better disclosure of these dividends on unvested stock, but not disallow this policy.

"All told, among the 50 large-company CEOs who received the largest dollar grants of restricted stock over the past three years and whose companies pay dividends, 37 are paid dividends in cash before the shares vest, according to an analysis for The Wall Street Journal by Equilar Inc., a San Mateo, Calif., compensation-research firm.

Corporate-governance watchdogs and executive-pay consultants say the dividends on performance shares undermine the effort to link pay to performance. "It's more stealth compensation," says Paul Hodgson, a senior research associate at the Corporate Library, which monitors corporate governance."

The full article is here.

New SEC rules will require better disclosure of these dividends on unvested stock, but not disallow this policy.

A slow two weeks

Posts this week and the next will be sparse. I'm travelling and dont have the same kind of access I had before. Thanks for your patience - this wont last long!

Sunday, April 30, 2006

Chevron and the Ecuadorian rainforest

In its annual meeting in Houston on Wednesday April 27th, Chevron's CEO David O'Reilly faced some tough questions.

The issue at stake is protest from environmental activists over the handling of a class-action lawsuit that alleges Texaco deliberately dumped more than 18 billion gallons of toxic "water of formation" into Ecuador's rainforest from 1964 to 1992. The lawsuit on trial in Ecuador claims that the contamination forced two indigenous groups to the brink of extinction and led to a surge in cancer rates.

How does this litigation in Ecuador affect the company's activities here in the US? Apparently Chevron failed to disclose this large potential liability to its shareholders in its SEC filings.

So representatives of Amazon Watch filed a complaint with the SEC over Chevron's failure to disclose the Ecuador liability to shareholders in their annual reports.

From their website:

The SEC then instructed Chevron to address this shareholder resolution in the meeting.

It's not clear what actually happened at the meeting, but

this article says it did not go well.

The issue at stake is protest from environmental activists over the handling of a class-action lawsuit that alleges Texaco deliberately dumped more than 18 billion gallons of toxic "water of formation" into Ecuador's rainforest from 1964 to 1992. The lawsuit on trial in Ecuador claims that the contamination forced two indigenous groups to the brink of extinction and led to a surge in cancer rates.

How does this litigation in Ecuador affect the company's activities here in the US? Apparently Chevron failed to disclose this large potential liability to its shareholders in its SEC filings.

So representatives of Amazon Watch filed a complaint with the SEC over Chevron's failure to disclose the Ecuador liability to shareholders in their annual reports.

From their website:

The only comprehensive assessment of the environmental damage, submitted by the American firm Global Environmental Operations, estimated that a clean-up would cost at least $6.14 billion. The estimate did not include personal damages to the thousands of victims in the region, nor compensation for the decades that the local population has lived in a degraded habitat – both of which together could double or even triple the clean-up cost.

Should these cost estimates pan out, the judgment could be the largest in history against an oil company.

All told, the Amazon Watch letter asserts that the California-based oil giant faces potential losses in the Ecuador lawsuit greater than 10 percent of its total assets.... Chevron faces a “staggering potential liability” in Ecuador but has not once disclosed the potential liability in its SEC filings...SEC vigilance is essential to ensuring the sort of frank corporate disclosure that protects individual investors and the overall health of our financial markets.”

The SEC then instructed Chevron to address this shareholder resolution in the meeting.

It's not clear what actually happened at the meeting, but

this article says it did not go well.

Is director compensation ratcheting up too ?

This article from the Chicago Tribune says it is.

Director compensation has risen sharply in the past few years as demands on boards have ratcheted up since the Sarbanes-Oxley corporate governance law passed in 2002.

A recent study by the Institutional Shareholder Services proxy advisory firm found that the average compensation for directors at the largest U.S. firms disclosed in 2005 proxies rose 14 percent, to just under $144,000. That's on top of a 23 percent increase a year earlier for what is, after all, part-time work.

This proxy season a Chicago Tribune review of a random sample of 50 Standard & Poor's 500 companies shows 60 percent increased pay compared with a year earlier, with the average cash retainer alone rising 14 percent, to $56,500. Another 10 percent announced plans to raise compensation for 2006.

To be sure, experts said, demands on directors have increased sharply in recent years. A study by the National Association of Corporate Directors found that the average estimated time spent on board service in 2005 reached 191 hours, up from 156 in 2003.

At average pay of $144,000, that works out to about $753 an hour.

Saturday, April 29, 2006

Pfizer :Corporate Governance and Executive Pay

Pfizer's shareholders who attended the company meeting this week expressed their disapproval of the company's executive compensation practices. This article from the WSJ says that

The surprising thing is that Pfizer has a good past record on corporate governance.

In June 2005, for example, Pfizer received two awards:

BusinessWeek Magazine cited Pfizer as a company on the vanguard of boardroom best practices, going out of its way to ensure that Directors are kept in the loop of what's really going on at the Company.

Also, the Vail Leadership Institute commended Pfizer for "Long Term Excellence in Corporate Governance".

Further back in 2004, Governance Metrics International (GMI) issued its highest overall rating of 10 to Pfizer for the third consecutive time. GMI gave special recognition to this achievement, noting that Pfizer's governance practices are "a clear recognition of the company's commitment to shareholder rights and progressive governance."

Here's the 'Corporate Governance Fact Sheet' from the company web page. One of the points mentioned is the lack of separation of the roles of CEO and Chairman of the Board. Shareholders recently voted on a proposal to separate these two jobs as well(this proposal drew 38.7% of the votes).

disgruntled investors are turning up in force at company annual meetings this year to demand better corporate governance and, in particular, some restraint in executive pay... Chairman and Chief Executive Henry "Hank" McKinnell could receive a lump-sum retirement payout valued at $83 million as of last Dec. 31. Mr. McKinnell is scheduled to step down in February 2008. As company shareholders entered the meeting at the Cornhusker Marriott here, a single-engine plane circled overhead pulling a banner reading in bright red letters: "Give it back Hank."

The surprising thing is that Pfizer has a good past record on corporate governance.

In June 2005, for example, Pfizer received two awards:

BusinessWeek Magazine cited Pfizer as a company on the vanguard of boardroom best practices, going out of its way to ensure that Directors are kept in the loop of what's really going on at the Company.

Also, the Vail Leadership Institute commended Pfizer for "Long Term Excellence in Corporate Governance".

Further back in 2004, Governance Metrics International (GMI) issued its highest overall rating of 10 to Pfizer for the third consecutive time. GMI gave special recognition to this achievement, noting that Pfizer's governance practices are "a clear recognition of the company's commitment to shareholder rights and progressive governance."

Here's the 'Corporate Governance Fact Sheet' from the company web page. One of the points mentioned is the lack of separation of the roles of CEO and Chairman of the Board. Shareholders recently voted on a proposal to separate these two jobs as well(this proposal drew 38.7% of the votes).

Thursday, April 27, 2006

Unifying dual-class shares: Part 2

Studies show that this trend towards unification of dual-class shares is motivated by sound reasoning.

Morck et al. (1988) and Shleifer and Vishny (1997) are some of the early papers that found that concentration of control rights (such as in Class A shares, a small proportion of the total shares outstanding) has a negative effect on firm value.

This new working paper confirms these results, adding that separation of voting from cash-flow rights through the use of dual-class shares, pyramiding, and cross-holdings is especially associated with lower market values.

A recent study of unifications by Dr. Anete Pajuste from her study entitled "Determinants and Consequences of the Unification of Dual-class Shares", available here makes the interesting argument that the reasons that once caused the introduction of dual-class shares, i.e., the need to issue new equity and to defend firm from a possible takeover, are the same that now motivate firms to switch back to one share-one vote. Here is the relevant passage from the paper:

Though this fashion-based argument appears to reduce the arguments for and against dual-class shares to a subjective basis, there are certainly compelling value-based reasons to unify, quoted in the same paper.

The results of this study, in fact, provide corroborating evidence to support the earlier studies that concluded that separation of ownership and voting rights reduces firm value, since firm value increases after the unification of the two classes of shares in the companies researched.

Morck et al. (1988) and Shleifer and Vishny (1997) are some of the early papers that found that concentration of control rights (such as in Class A shares, a small proportion of the total shares outstanding) has a negative effect on firm value.

This new working paper confirms these results, adding that separation of voting from cash-flow rights through the use of dual-class shares, pyramiding, and cross-holdings is especially associated with lower market values.

A recent study of unifications by Dr. Anete Pajuste from her study entitled "Determinants and Consequences of the Unification of Dual-class Shares", available here makes the interesting argument that the reasons that once caused the introduction of dual-class shares, i.e., the need to issue new equity and to defend firm from a possible takeover, are the same that now motivate firms to switch back to one share-one vote. Here is the relevant passage from the paper:

.....One of the factors is the change in fashion. In 1984, the New York Stock Exchange (NYSE) undertook a revaluation of its policy (introduced in 1957) not to list companies with dual-class share structure. The discrimination of dual-class shares on NYSE ceased to exist in 1986.3 This step improved the marketability of dual-class shares. The increased reorganizations of corporate voting rights was also common in response to the takeover boom of the 1980s. In recent years, the fashion has arguably changed. In the aftermath of Enron and other corporate governance scandals, anything that can potentially increase the managerial entrenchment becomes suspicious. The popularity of dual-class shares, one of the most obvious and visible tools for increasing managerial (or large shareholder) entrenchment, has been adversely affected. As a result, the companies that need to approach the investors for new capital are the ones that cannot afford to be out of fashion.

Though this fashion-based argument appears to reduce the arguments for and against dual-class shares to a subjective basis, there are certainly compelling value-based reasons to unify, quoted in the same paper.

The results of this study, in fact, provide corroborating evidence to support the earlier studies that concluded that separation of ownership and voting rights reduces firm value, since firm value increases after the unification of the two classes of shares in the companies researched.

Monday, April 24, 2006

Unifying dual-class shares : Part 1

Recent days have seen a big move worldwide towards eliminating a dual-class share structure (Two classes of shares, for example Class A and Class B; where one class has substantially more voting power, or all the voting power, and the other class has very little or none).

Brazil's telecom company Telemar recently is looking to unify its share classes. (WSJ Subscription article). In the US, Eagle Materials recently decided to unify its two share classes.

New York hedge fund Atlantic Investment Management Inc. and Morgan Stanley are arguing that the New York Times Co. (NYT) should end its dual-class share structure.

Two questions.

The first: Why unify?

When a company's board and management are accountable only to a small group of people who hold very little of the actual fraction of shares outstanding, but all of the voting power, there is potential for decisions that are not in the common shareholder's interest.

Take the case of the aforementioned New York Times. Here's what Morgan Stanley Invmt. Management had to say about its reasons for supporting unification of NYT shares:

"MSIM contends that the Board and management at The New York Times Company have failed to fulfill (their) responsibilities effectively.While (dual class shares) may have at one time been designed to protect the editorial independence and the integrity of the news franchise, the dual-class voting structure now fosters a lack of accountability to all of the company's shareholders."

New York Times Co. stock has dropped 52% since its peak in June 2002, Morgan Stanley says. But "despite significant underperformance, management's total compensation is substantial and has increased considerably over this period. As a long-term, committed shareholder since 1996, MSIM has privately conveyed its concerns to the company's Board and senior management on a number of occasions and has suggested substantive strategies to operate the business better and allocate capital more efficiently. However, to date, the Board and management have failed to take the actions necessary to improve operational and financial performance."

Another article that explains why NYT is making the wrong decisions is here.

NYT is by no means alone in this quandary. Google Inc. has a dual class structure too, with its top three executives owning most of the voting shares, and the general public owning the Class B or non-voting shares. This decision cost Google in terms of its corporate governance ranking with ISS, the Institutional Shareholder Services.

So that answers the why. The second question is the 'how'?

Or more specifically, can the dual-class shareholder structure be changed?

Motley Fool argues that efforts to fight the dual-class share structure can be futile, once again, because the method of doing so usually involves a shareholder vote. In 1999, the big California pension fund CalPERS took on the dual-class structure at Tyson Foods (NYSE: TSN), arguing that the company had underperformed for years while under the dictatorial control of the founding family, and thus a recapitalization under a single-class structure was warranted. This push was rejected by Tyson's board (the putative advocates of shareholders) and defeated by the Tyson family's supervote.

And ISS also takes a dim view of the likelihood of being able to fight the dual class structure, if the owners of Class A shares were resistant to the idea of unification.

- from the ISS corporate governance blog,this post.

Next up in part 2: results of studies on the costs and drawbacks of having a dual-class structure.

Brazil's telecom company Telemar recently is looking to unify its share classes. (WSJ Subscription article). In the US, Eagle Materials recently decided to unify its two share classes.

New York hedge fund Atlantic Investment Management Inc. and Morgan Stanley are arguing that the New York Times Co. (NYT) should end its dual-class share structure.

Two questions.

The first: Why unify?

When a company's board and management are accountable only to a small group of people who hold very little of the actual fraction of shares outstanding, but all of the voting power, there is potential for decisions that are not in the common shareholder's interest.

Take the case of the aforementioned New York Times. Here's what Morgan Stanley Invmt. Management had to say about its reasons for supporting unification of NYT shares:

"MSIM contends that the Board and management at The New York Times Company have failed to fulfill (their) responsibilities effectively.While (dual class shares) may have at one time been designed to protect the editorial independence and the integrity of the news franchise, the dual-class voting structure now fosters a lack of accountability to all of the company's shareholders."

New York Times Co. stock has dropped 52% since its peak in June 2002, Morgan Stanley says. But "despite significant underperformance, management's total compensation is substantial and has increased considerably over this period. As a long-term, committed shareholder since 1996, MSIM has privately conveyed its concerns to the company's Board and senior management on a number of occasions and has suggested substantive strategies to operate the business better and allocate capital more efficiently. However, to date, the Board and management have failed to take the actions necessary to improve operational and financial performance."

Another article that explains why NYT is making the wrong decisions is here.

NYT is by no means alone in this quandary. Google Inc. has a dual class structure too, with its top three executives owning most of the voting shares, and the general public owning the Class B or non-voting shares. This decision cost Google in terms of its corporate governance ranking with ISS, the Institutional Shareholder Services.

So that answers the why. The second question is the 'how'?

Or more specifically, can the dual-class shareholder structure be changed?

Motley Fool argues that efforts to fight the dual-class share structure can be futile, once again, because the method of doing so usually involves a shareholder vote. In 1999, the big California pension fund CalPERS took on the dual-class structure at Tyson Foods (NYSE: TSN), arguing that the company had underperformed for years while under the dictatorial control of the founding family, and thus a recapitalization under a single-class structure was warranted. This push was rejected by Tyson's board (the putative advocates of shareholders) and defeated by the Tyson family's supervote.

And ISS also takes a dim view of the likelihood of being able to fight the dual class structure, if the owners of Class A shares were resistant to the idea of unification.

It should come as no surprise that ISS is against the establishment of dual-class equity structures in all cases as it is the single most disenfranchising thing a company can do to investors... We almost always support shareholder proposals seeking to eliminate dual-class structures. The actual elimination, of course, never happens because the people who benefit most from dual class structures control the voting power at the company. However, because these structures have a long legacy, we generally do not proactively withhold votes from directors at companies with dual-class structures in place unless there are other significant governance issues.

- from the ISS corporate governance blog,this post.

Next up in part 2: results of studies on the costs and drawbacks of having a dual-class structure.

Sunday, April 23, 2006

Do managers who present misleading financial information lose their jobs?

I should hope so ! Here are a couple of interesting studies that find that managers do face consequences from improper or misleading reporting.

Desai, Hogan and Wilkins (The Reputational Penalty for Aggressive Accounting:. Earnings Restatements and Managing Turnover,2005) examine management turnover and the subsequent re-hiring of displaced managers at firms announcing earnings restatements during 1997 or 1998.

In a sample of 146 firms that announced restatements in 1997 and 1998, they find

that at least one senior manager (Chairman, CEO or President) loses his/her job within 24 months of the announcement of the restatement in 60% of the firms. The corresponding rate of turnover among firms of similar size, age and in the same industry is 35%. The significant difference in turnover persists even after controlling for other factors associated with management turnover, such as performance, bankruptcy, and governance characteristics. Moreover, only 17 out of 114 (15%)displaced managers of the sample firms secure a comparable position at another public firm, compared to 17 out of 63 (27%) displaced managers at the control firms.

Livingston(Management-Borne Costs of Fraudulent and Misleading Financial Reporting, 1996) finds that after controlling for firm performance and financial distress, top managers and financial officers are more likely to be dismissed in the years following misleading reporting than in other years. For top executives, an SEC enforcement action has also associated with a higher frequency of turnover.

And here's the best part.

Directors on the board of companies which are found to have committed fraud are penalized too. Fich and Shivdasani (2005) find that upon revelation of fraud, outside directors are less likely to retain their directorships of fraud and non-fraud firms.

Desai, Hogan and Wilkins (The Reputational Penalty for Aggressive Accounting:. Earnings Restatements and Managing Turnover,2005) examine management turnover and the subsequent re-hiring of displaced managers at firms announcing earnings restatements during 1997 or 1998.

In a sample of 146 firms that announced restatements in 1997 and 1998, they find

that at least one senior manager (Chairman, CEO or President) loses his/her job within 24 months of the announcement of the restatement in 60% of the firms. The corresponding rate of turnover among firms of similar size, age and in the same industry is 35%. The significant difference in turnover persists even after controlling for other factors associated with management turnover, such as performance, bankruptcy, and governance characteristics. Moreover, only 17 out of 114 (15%)displaced managers of the sample firms secure a comparable position at another public firm, compared to 17 out of 63 (27%) displaced managers at the control firms.

Livingston(Management-Borne Costs of Fraudulent and Misleading Financial Reporting, 1996) finds that after controlling for firm performance and financial distress, top managers and financial officers are more likely to be dismissed in the years following misleading reporting than in other years. For top executives, an SEC enforcement action has also associated with a higher frequency of turnover.

And here's the best part.

Directors on the board of companies which are found to have committed fraud are penalized too. Fich and Shivdasani (2005) find that upon revelation of fraud, outside directors are less likely to retain their directorships of fraud and non-fraud firms.

Eliminating a dual-class share structure: Part 1

Recent days have seen a big move worldwide towards eliminating a dual-class share structure (Two classes of shares, for example Class A and Class B; where one class has substantially more voting power, or all the voting power, and the other class has very little or none).

Brazil's telecom company Telemar recently is looking to unify its share classes. (WSJ Subscription article). In the US, Eagle Materials recently decided to unify its two share classes.

New York hedge fund Atlantic Investment Management Inc. and Morgan Stanley are arguing that the New York Times Co. (NYT) should end its dual-class share structure.

Two questions.

The first: Why unify?

When a company's board and management are accountable only to a small group of people who hold very little of the actual fraction of shares outstanding, but all of the voting power, there is potential for decisions that are not in the common shareholder's interest.

Take the case of the aforementioned New York Times. Here's what Morgan Stanley Invmt. Management had to say about its reasons for supporting unification of NYT shares:

"MSIM contends that the Board and management at The New York Times Company have failed to fulfill (their) responsibilities effectively.While (dual class shares) may have at one time been designed to protect the editorial independence and the integrity of the news franchise, the dual-class voting structure now fosters a lack of accountability to all of the company's shareholders."

New York Times Co. stock has dropped 52% since its peak in June 2002, Morgan Stanley says. But "despite significant underperformance, management's total compensation is substantial and has increased considerably over this period. As a long-term, committed shareholder since 1996, MSIM has privately conveyed its concerns to the company's Board and senior management on a number of occasions and has suggested substantive strategies to operate the business better and allocate capital more efficiently. However, to date, the Board and management have failed to take the actions necessary to improve operational and financial performance."

Another article that explains why NYT is making the wrong decisions is here.

NYT is by no means alone in this quandary. Google Inc. has a dual class structure too, with its top three executives owning most of the voting shares, and the general public owning the Class B or non-voting shares. This decision cost Google in terms of its corporate governance ranking with ISS, the Institutional Shareholder Services.

So that answers the why. The second question is the 'how'?

Or more specifically, can the dual-class shareholder structure be changed?