If you know what options backdating is all about, skip this paragraph and go to the next one. For the benefit of readers who don't, here's a short summary. Employee stock options to buy shares at a preset "strike" price became a widespread form in the last 15 years or so. Recently, investigations have found that companies artificially set the grant date of these options to a day on which stock prices have been at a low ebb, thereby assuring executives of a fat profit on the day they are granted. By tying strike prices to earlier, more favorable dates, executives granted options can instantly lock in a paper gain -- and, if a stock goes up, increase their real gain when they exercise them. This defeats the incentive effect of employee stock options, which is to reward the executive only when their contributions result in a stock price increase. In the words of Dr. David Yermack, "The whole point of a stock option (as an incentive mechanism) is that you only profit if the stock goes up. If you fix it in advance so that it's already deep in the money, it eliminates a lot of the risk."

News sources including this one credit the discovery of this manipulation to Dr. Erik Lie and other academic researchers.

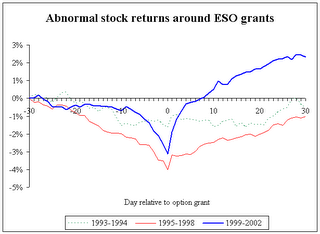

"A study, by Erik Lie, a finance professor at the University of Iowa's business school, looked at thousands of option grants. On average, he found a pattern of stocks dipping sharply just before the date of option grants, then rising immediately afterward -- even after adjusting for overall market returns. Equally striking, he found market prices as a whole tended to rise after grants -- which he suggested shows that executives may have backdated options, already knowing how the market moved.

A second study, by Prof. Lie and Randall Heron of Indiana University's business school, showed the patterns all but ceased after August 2002, when rules put in place by the Sarbanes-Oxley corporate-reform law began requiring executives to report option grants to regulators within two days, instead of the weeks or months previously allowed. With less leeway to choose a favorable grant date, "most of the effect disappeared," said Prof. Lie."

A great, simple explanation of this topic is found at Professor Lie's website here. The following graph from his website provides a good illustration of the magnitude of this problem, as the effect appears strong even after averaging over thousands of companies.

The latest developments including a timeline of options investigations, and the list of companies that have been caught backdating options are succinctly summarized in these WSJ articles.

No comments:

Post a Comment